the most suitable insurance programme?

In the field

solution

master

programme

Share:

Some companies are more suited to an international controlled master programme: a single ‘umbrella of insurance policies’ that covers all of the business’s risks worldwide. For other companies, stand-alone managed solutions with individual policies per country and/or location are more suitable. So, what determines the most suitable insurance programme? Michel van der Linden (CFO of Suitsupply) and Evert Jan van Garderen (CEO of Eurcommercial Properties) explain. There are also companies that are more suited to a hybrid solution – a combination of both policies.

International controlled master programme

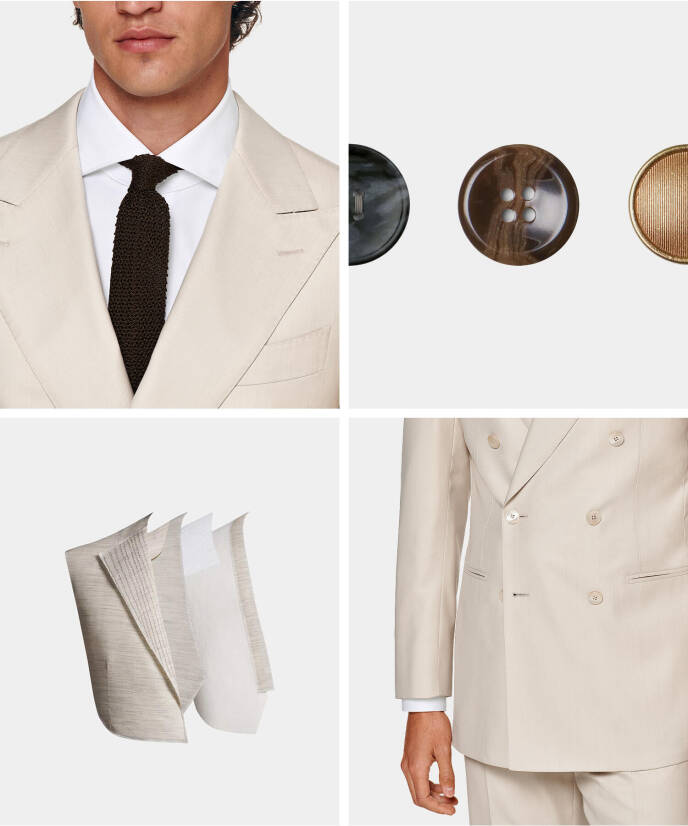

‘Suitsupply is a Dutch company established in 2000 by Fokke de Jong. We are known worldwide for our high quality menswear and our focus is on craftsmanship, personal service and fast and direct sales channels, including our stores and webshop. We operate in a market in which new trends are certainly important but where consistency is the crucial factor. Suitsupply uses a vertically integrated business model and exercises full chain management: from product development, purchasing and production to marketing and omni-channel distribution. This also applies to our production and logistics, which we subcontract to leading parties with whom we maintain strong and sustained relations. We have over 100 stores in Europe, the US, Australia, Canada and China and we employ the same concept all over the world. We manage our worldwide organisation in a centralised manner from our head office in Amsterdam, with support from our offices in New York and Shanghai.’

Centralised approach

‘With respect to risk management and insurance, we opt for the same centralised approach through an international controlled master programme. One overarching insurance programme for the whole world, with an additional local policy if required. Fire damage is one of our main worldwide risks. Meijers Global and Specialty has identified our group interdependencies in the value chain. Our warehouses are closely connected to our stores. If there is a fire at one of our distribution centres, it has a direct effect on the supply of our stores worldwide. Fires and other risks are covered for us by one overarching insurance programme. This also applies to liability and transport. As a centrally organised business, it is great to be able to work with one insurance broker who coordinates everything.’

‘Our worldwide organisation is managed in a centralised manner.

That is why we have an overarching insurance programme for all our worldwide risks’

Company: Suitsupply

Active in: 24 countries worldwide

Insurance programme: International controlled master programme

Interview with: Michel van der Lingen (CFO)

Onderneming: Eurocommercial Properties

Active in: 4 countries in Europe

Insurance programme: Stand alone managed solutions

Interview with: Evert Jan van Garderen (CEO)

Stand alone managed solutions

‘We are an international listed property investor specialised in the operation of shopping centres in Europe. At the moment, we have 24 centres in Belgium, France, Italy and Sweden. We used to manage the business operations of our entire organisation from our head office in the Netherlands, including our risk management and insurance cover. However, this wasn’t an optimal situation because we were managing unique properties in each country and location. We had to deal with different tenants, customers and different kinds of risks in each shopping centre, genuinely local business in other words. The country directors, property managers and shopping centre managers are the ones who are closest to the reality on the ground. So, a few years ago we decided to decentralise our organisation and to give priority to their local knowledge and experience. They were in the best position to assume direct responsibility for their country and shopping centres.’

Decentralisation

‘This decentralisation enabled us to choose a local strategy for risk management and insurance, one to which our stand-alone managed solutions are perfectly suited. Meijers Global & Specialty provides us with local policies that match the different situations per country and location, which in turn facilitates a direct connection between our local personnel and local insurance intermediaries. It also contributes to a heightened sense of local responsibility. The greatest risk our company faces is fire. It can lead to significant losses in rental revenues and so we make sure it is fully covered by insurance. In addition, with millions of customers visiting our shopping centres and thousands of retailers doing business there, issues relating to liability are always bound to arise and the risk to reputation is significant, too, in the case of claims. That risk is insured centrally, with local policies covering the settlement of claims. Cyber risk is obviously another major risk. We manage our business using tenant and visitor data stored in our Client Relation Management System (CRM). We also have smart energy systems in our shopping centres, which brings other risks with it as well. Electricity supplies can be vulnerable and can fail in the case of a cyber attack, with all the obvious consequences, and we are very aware of this. In this potential minefield of risks, Meijers is our coordinating international broker, knowledge partner and specialist in risk management and insurance. We are kept fully abreast of all new developments and given an insight into the results of their market research and benchmarks in the insurance market. They also provide excellent documentation and reports, which strengthens our position in negotiations with local providers of financing and mortgages.’

‘We make a conscious choice for local responsibility.

Including for our local brokers and policies’

commercial Properties

Hybrid solution

There are also companies that choose for a balance between centralised international risk management and local responsibility. The most suitable option in that case is a hybrid solution: an optimal tailor-made mix of a global Master policy and local stand alone policies. Meijers Global & Specialty also manages these from Amstelveen and works closely together with international networks of local brokers.

All overarching corporate risks are carefully mapped out and fall under the Master policy. Based on criteria set out in advance, each country is assessed to determine whether the local situation should be added to the corporate policy or whether a local solution would be better. If a local policy is the preferred option, the corporate policy offers Difference in Conditions and Difference in Limits coverage. In this way the interests of the group are always safeguarded. Local policies are drawn up by local insurance brokers and claims are also processed locally.

The hybrid solution offers the best of both worlds: in worldwide business dynamics and on the local front. Meijers Global & Specialty acts as the coordinating partner and ensures optimal insight into the risks, the best insurance solutions, maximum efficiency and attractive premiums.

An international insurance programme always requires a tailor-made approach. Want to find out more?

Table of contents

the most suitable insurance programme?

In the field

solution

master

programme

Share:

Some companies are more suited to an international controlled master programme: a single ‘umbrella of insurance policies’ that covers all of the business’s risks worldwide. For other companies, stand-alone managed solutions with individual policies per country and/or location are more suitable. So, what determines the most suitable insurance programme? Michel van der Linden (CFO of Suitsupply) and Evert Jan van Garderen (CEO of Eurcommercial Properties) explain. There are also companies that are more suited to a hybrid solution – a combination of both policies.

‘Our worldwide organisation is managed in a centralised manner.

That is why we have an overarching insurance programme for all our worldwide risks’

Interview with: Michel van der Lingen (CFO)

Insurance programme: International controlled master programme

Active in: 24 countries worldwide

‘Suitsupply is a Dutch company established in 2000 by Fokke de Jong. We are known worldwide for our high quality menswear and our focus is on craftsmanship, personal service and fast and direct sales channels, including our stores and webshop. We operate in a market in which new trends are certainly important but where consistency is the crucial factor. Suitsupply uses a vertically integrated business model and exercises full chain management: from product development, purchasing and production to marketing and omni-channel distribution. This also applies to our production and logistics, which we subcontract to leading parties with whom we maintain strong and sustained relations. We have over 100 stores in Europe, the US, Australia, Canada and China and we employ the same concept all over the world. We manage our worldwide organisation in a centralised manner from our head office in Amsterdam, with support from our offices in New York and Shanghai.’

Centralised approach

‘With respect to risk management and insurance, we opt for the same centralised approach through an international controlled master programme. One overarching insurance programme for the whole world, with an additional local policy if required. Fire damage is one of our main worldwide risks. Meijers Global and Specialty has identified our group interdependencies in the value chain. Our warehouses are closely connected to our stores. If there is a fire at one of our distribution centres, it has a direct effect on the supply of our stores worldwide. Fires and other risks are covered for us by one overarching insurance programme. This also applies to liability and transport. As a centrally organised business, it is great to be able to work with one insurance broker who coordinates everything.’

Company: Suitsupply

International controlled master program

commercial Properties

‘We make a conscious choice for local responsibility.

Including for our local brokers and policies’

‘We are an international listed property investor specialised in the operation of shopping centres in Europe. At the moment, we have 24 centres in Belgium, France, Italy and Sweden. We used to manage the business operations of our entire organisation from our head office in the Netherlands, including our risk management and insurance cover. However, this wasn’t an optimal situation because we were managing unique properties in each country and location. We had to deal with different tenants, customers and different kinds of risks in each shopping centre, genuinely local business in other words. The country directors, property managers and shopping centre managers are the ones who are closest to the reality on the ground. So, a few years ago we decided to decentralise our organisation and to give priority to their local knowledge and experience. They were in the best position to assume direct responsibility for their country and shopping centres.’

Decentralisation

‘This decentralisation enabled us to choose a local strategy for risk management and insurance, one to which our stand-alone managed solutions are perfectly suited. Meijers Global & Specialty provides us with local policies that match the different situations per country and location, which in turn facilitates a direct connection between our local personnel and local insurance intermediaries. It also contributes to a heightened sense of local responsibility. The greatest risk our company faces is fire. It can lead to significant losses in rental revenues and so we make sure it is fully covered by insurance. In addition, with millions of customers visiting our shopping centres and thousands of retailers doing business there, issues relating to liability are always bound to arise and the risk to reputation is significant, too, in the case of claims. That risk is insured centrally, with local policies covering the settlement of claims. Cyber risk is obviously another major risk. We manage our business using tenant and visitor data stored in our Client Relation Management System (CRM). We also have smart energy systems in our shopping centres, which brings other risks with it as well. Electricity supplies can be vulnerable and can fail in the case of a cyber attack, with all the obvious consequences, and we are very aware of this. In this potential minefield of risks, Meijers is our coordinating international broker, knowledge partner and specialist in risk management and insurance. We are kept fully abreast of all new developments and given an insight into the results of their market research and benchmarks in the insurance market. They also provide excellent documentation and reports, which strengthens our position in negotiations with local providers of financing and mortgages.’

Stand alone managed solutions

Interview with: Evert Jan van Garderen (CEO)

Insurance programme: Stand alone managed solutions

Active in: 4 countries in Europe

Onderneming: Eurocommercial Properties

Table of contents

The hybrid solution offers the best of both worlds: in worldwide business dynamics and on the local front. Meijers Global & Specialty acts as the coordinating partner and ensures optimal insight into the risks, the best insurance solutions, maximum efficiency and attractive premiums.

An international insurance programme always requires a tailor-made approach. Want to find out more?

There are also companies that choose for a balance between centralised international risk management and local responsibility. The most suitable option in that case is a hybrid solution: an optimal tailor-made mix of a global Master policy and local stand alone policies. Meijers Global & Specialty also manages these from Amstelveen and works closely together with international networks of local brokers.

All overarching corporate risks are carefully mapped out and fall under the Master policy. Based on criteria set out in advance, each country is assessed to determine whether the local situation should be added to the corporate policy or whether a local solution would be better. If a local policy is the preferred option, the corporate policy offers Difference in Conditions and Difference in Limits coverage. In this way the interests of the group are always safeguarded. Local policies are drawn up by local insurance brokers and claims are also processed locally.

Hybrid solution